Real estate constitutes the largest asset class in the world as it is considered a relative safe harbor. In 2022, the worldwide real estate market was worth $3.88 trillion, according to Grand View Research and was projected to grow steadily at a compound annual growth rate (CAGR) of 5.2% from 2022 to 2030. Real estate market in Bangladesh is also a key driver of economic growth, reflecting the country’s development trajectory. The scenario of the nation’s real estate industry is expected to undergo substantial changes this year. The surge in new construction projects in Dhaka, including both modern apartments and high-rise commercial buildings is driven by the influx of people seeking better job prospects and higher wages. Businesses in the housing sector are capitalizing on this trend, benefiting from factors such as a growing middle-class population, reduced land registration fees, favorable bank loan terms, home loans for government employees, and opportunities for investment using undisclosed funds. Similar to the RMG sector, the real estate market has emerged as a thriving and well-established industry, boasting a market size exceeding $5.4 billion with an annual average growth rate of 9%.

At present, the idea of real estate is gradually evolving into not just developing residential apartments, but also model towns, commercial and industrial facilities, and important infrastructure. Also, logistics real estate is the new fast-developing subsector in this industry. The Real Estate & Housing Association of Bangladesh (REHAB) has 852 companies enlisted as developer companies, with over 1073 registered companies.

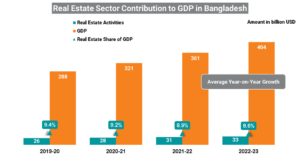

Bangladesh is continuing the positive trend to accommodate its expanding population and making significant profits contributing to economic growth. In the fiscal year 2022-2023, when the country’s GDP reached around $404 billion, the real estate sector contributed $33 billion, which amounted to 8.6% of the total GDP (BBS).

Key players in the real estate industry are Concord Real Estate Ltd, Asset Developments Ltd, Building Technology & Ideas (BTI), Shanta Holdings Ltd, Anwar Landmark, Rangs Properties Ltd, Bashundhara Group, Sheltech, Edison Real Estate Ltd, Assurance Developments Ltd, Amin Mohammad Lands Developments Ltd, Mir Real Estate Ltd etc. Another compelling aspect of assets is their resilience to economic fluctuations, including inflation, recession, or other adversities. Unlike many sectors, asset prices tend to remain stable or even appreciate over time, providing a safe and low-risk option for investors with guaranteed capital appreciation.

While the real estate industry in Bangladesh shows potential, it still grapples with various challenges, outlined below:

1. Land Acquisition Issues:

- Acquiring land often faces hurdles such as disputes, unclear ownership, and lengthy legal procedures, leading to project delays, increased costs, and uncertainty.

- The market is vulnerable to economic shifts, such as interest rate fluctuations and inflation, as seen from 2018-2020. However, sales have recently picked up, and the industry is flourishing again.

2. Affordable Housing Shortage:

- There is a significant shortage of affordable housing, with about 80% of city dwellers renting as opposed to buying due to the high cost of land and apartments (Funnel & Khan, 2022).

- The demand for urban housing is estimated at 6 million units, expected to rise to 10.5 million by 2030.

3. Access to Suitable Land:

- Finding affordable land for housing projects is challenging, with high costs and regulatory hurdles increasing construction expenses and causing delays.

- Affordable housing requires cost-effective construction methods and concessional financing with lower interest rates or longer repayment terms.

To address these challenges of developing affordable housing in Bangladesh, several targeted solutions can be implemented. To address land acquisition issues, consulting/market research firms can provide strategic advice on mitigating risks associated with economic shifts, such as interest rate fluctuations. Also, the government can allocate publicly owned land for affordable housing projects, reducing acquisition costs for developers and ensuring suitable land availability. Implementing mechanisms to recapture increases in land value, due to public investments, can also provide additional funding for affordable housing initiatives.

Besides, to mitigate affordable housing shortage, market research on the housing industry can be conducted to understand the demand for affordable housing and identify potential areas for development. Again, financial institutions can offer affordable and economical housing bond instruments with a minimal deposit to provide middle-income earners an opportunity to own a home someday.

The challenge relating to access to suitable land can be mitigated by conducting feasibility studies to identify suitable land parcels for housing projects. Along with that, improving land records and implementing transparent, digital land registration systems should be strengthened to ensure clear ownership and enhance transparency between both parties. By implementing these targeted solutions, Bangladesh can make significant strides towards addressing its affordable housing challenges.

In a groundbreaking move to address the affordable housing challenge, the International Finance Corporation (IFC) is investing up to $50 million, in Bangladeshi Taka (BDT), in a bond that BRAC Bank will issue. This bond, which will be in local currency and have a term of up to five years, is privately placed, meaning it is offered to a select group of investors rather than the public. The purpose of this investment is to support BRAC Bank’s housing finance program, which aims to provide more affordable home loans. (Funnel & Khan, 2022). This housing bond facilitates this goal by providing financing for homebuyers who struggle to access affordable loans. More initiatives such as these can enhance and improve housing solutions.

By conducting comprehensive market research and analysis, stakeholders can identify trends, assess market demand, and propose innovative solutions for land acquisition and affordable housing. Collaboration amongst the real estate companies, government, market research agencies, and development partners can contribute to the development of sustainable and inclusive housing options, driving economic growth and social advancement in Bangladesh.

All figures use an exchange rate of 110 BDT per USD, with data retrieved from BBS.

Contributors: Fahmida Faruque from Data Analytics & Emerging Frontiers Portfolio at Innovision Consulting.